Just Child's Play? Risk? What's That?

- Sarvesh Kondejkar

- Dec 16, 2023

- 2 min read

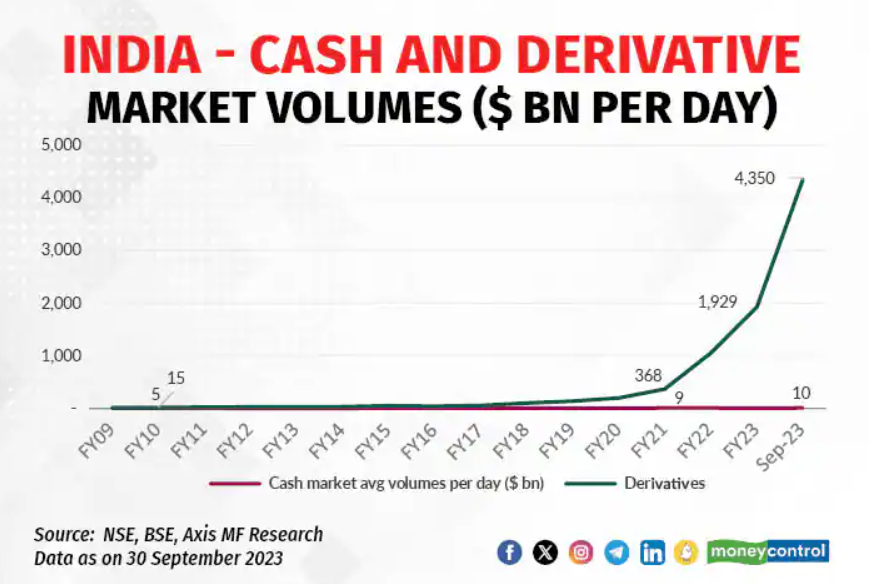

A ratio of 422X for India which was 3X in 2010 in the context of derivatives volume to cash trading volume would imply an extremely high level of derivatives trading activity relative to cash trading activity. Currently our derivates volume are over 4.3 trillion dollar which is approximately 125% of underlying companies market capitalization.

Let's Understand the significance behind the ratio -

Speculation and Risk: A ratio as high as 422 indicates that our substantial portion of trading in India's financial markets is driven by speculation and derivative instruments. Such type of high ratio can lead to high market volatility.

Liquidity: The high ratio might indicate that India's derivatives markets are relatively more liquid and active. This we can seen as a sign of market depth and the ability for traders to enter and exit positions more easily.

Market Sentiment: Such a high ratio can also reflect the market sentiment, which may be driven by various factors such as expectations about future price movements, interest rates, or geopolitical events. High ratios here is suggesting that traders are actively positioning themselves based on these sentiments or they are here just for Profits.

Regulatory Environment: It's important for regulators to keep monitoring our markets. Regulatory authorities may need to be vigilant in ensuring fair and transparent market operations and managing risks associated with speculative trading.

Investor Behavior: The high ratio may also indicate a preference among investors for using derivatives for various purposes, including hedging, speculating, or managing risk. Which can be seen as our equity retail investors is 35 and with discount brokers it is 29 years.

My main concern is during extreme volatility or black swan event, when everywhere there is uncertainty, this shouldn't have a domino effect leading to a huge crisis which can go out of hand.

Trade with caution and with hedging.

Comments